The Hellenic Competition Commission may initiate a mapping study to assess the competitive conditions of competition in any market or sector of the economy, when required for the effective exercise of its powers (Article 14(2) subpar. s of Law 3959/2011).

By Decision adopted in February 2023, the Hellenic Competition Commission launched a mapping study on the conditions of competition, inter alia, in the market for plain yoghurt from cow’s milk. In particular, this mapping study focuses on:

a) the evolution of the 11 largest Supermarkets’ market shares (“SMs”) (downstream market);

b) the evolution of the suppliers’ (of both private label and branded products) market shares in the 11 SMs’ sales (upstream market);

c) the effect of the Household Basket (HB) mechanism on prices of branded and private label products;

d) the change in consumers' purchasing habits, by comparing branded products with private label products, both those included and those non-included in the HB.

As part of the above mapping study, questionnaires were sent by the Directorate-General for Competition to 11 supermarkets which have a combined market share of more than 95% in the food-retailing market. The period for which data was obtained extends over the 52 weeks between 1/2/2022 and 1/2/2023 ("reference period"). The main results are summarised below:

- In terms of market size, total yoghurt sales from super markets during the reference reriod amount to €133.4 million, with a weighted average price of €3.02/kg.

- In total sales, the largest market share (in terms of value) is held by the super market "Sklavenitis" (30-40%), followed by "AB-Vassilopoulos" and "Lidl" (10-20%). "My Market" and "Galaxias" hold a market share between 5% and 10%, with the other SMs holding a market share between 0-5%.

- On the basis of sales value in branded yoghurts, the largest market share in sales is held by "SKLAVENITIS" (30%-40%), followed by "AB-Vassilopoulos" (15%-20%). On the basis of sales value in private label products, the largest market share in sales is held by "LIDL" (40%-50%), followed by "SKLAVENITIS" (20%-30%), "AB-Vassilopoulos" ( 10%-15%) and "My Market" (5%-10%).

- In the period 15/11/2022-31/1/2023 for which data was collected on the operation of the HB, no significant change is observed in the SMs’ market shares.

- The number of yoghurt suppliers is 71. The largest market share in sales (based on value), regardless of whether it concerns branded or private label products, is held by the company "KRI KRI", followed by "FAGE" and "HELLENIC DAIRIES". A small market share, between 0-5%, is held, inter alia, by the companies "FRIESLAND CAMPINA", "NUMIL", "KOUKAKI", "MEVGAL", "Naabtaler", "EVROFARMA", "SERGAL" and "STAMOU".

- The largest market share in the sales (in value) of SMs in branded productsis held by the company "FAGE", followed by the companies " HELLENIC DAIRIES " and "KRI KRI". In relation to private labelproducts, only two suppliers have a share of more than 10%, namely the company "KRI KRI", which is the major supplier by far compared to the others, and the company "KOLIOS".

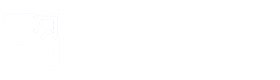

- As to price evolution, during the HB’s implementation period, the weighted average price of in-basket products remained almost stable while the price of off-basket products increased by 17 cents (See Chart below).

- Overall, during the reference period, off-HB product prices increased, but in-HB product prices showed a remarkable stability.In general, SMs keep the prices of HB products stable, notably of private label products.In particular, during the 1st week of the HB’s implementation, the average price of the in-basket products was 2.19 €/Kg, while the corresponding price of the off-basket products was 3.29 €/Kg. This price difference increased by 15 cents by the end of the reference period, namely at week 52. It is worth noting, however, that 81% of HB product sales volume concerns private label products, which are consistently priced lower than branded products, although the share of private label products in total sales has remained relatively lower.

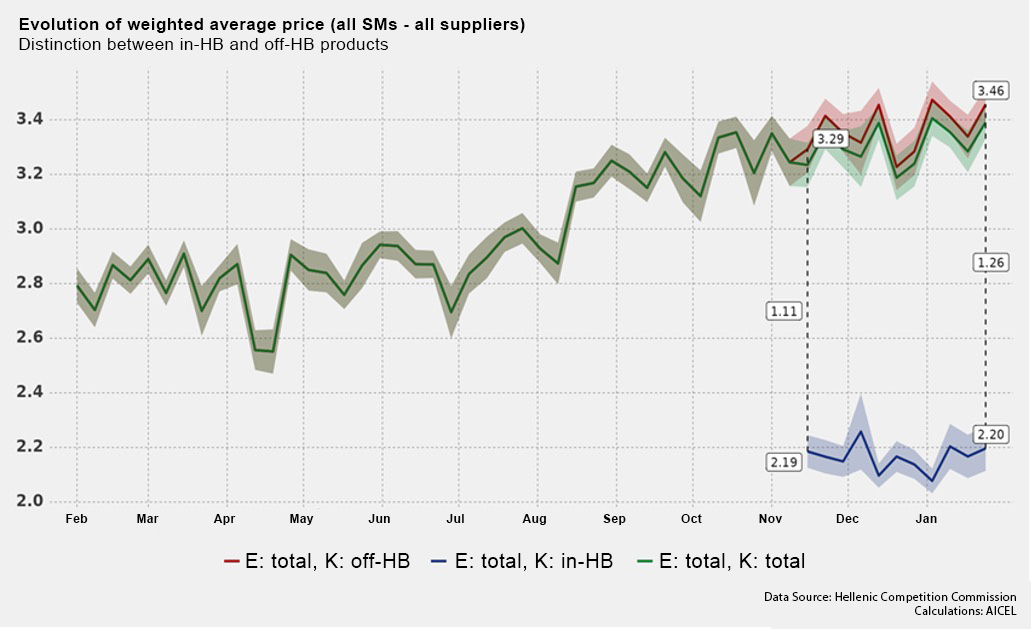

- In terms of consumer preferences, a small shift was observed towards private label products during the reference period. In the 1st week of observations, sales (in volume) of private label products corresponded to 36.3%, while in the 52nd week of observations, the percentage increased to 41.9%. In particular, the percentage of sales (in volume) of private label products included in the HB, sold by Supermarkets, ranged from 3.2%-4.5%.

In the period 15/11/2022-31/1/2023, for which data on the operation of the HB was collected, the HB does not appear to have significantly affected consumer preferences.