The Hellenic Competition Commission may initiate a mapping study to assess the competitive conditions of competition in any market or sector of the economy, when required for the effective exercise of its powers (Article 14(2) subpar. s of Law 3959/2011). In this context, the Authority launched a mapping study on the conditions of competition in the market for Fetacheese. It is noted that Feta cheese accounts for 2% of the total sales of the 11 largest Supermarkets.

In particular, this mapping study focuses on:

- the evolution of the market shares of the 11 largest Supermarkets (hereinafter referred to as “SMs”)

- the evolution of the shares of suppliers (of private label and branded products) in the sales of the 11 SMs

- the effect of the Household Basket mechanism (hereinafter referred to as “HB”) on the prices of branded products and private label products

- the effect of the HB mechanism on the purchasing habits of consumers following the comparison between branded products and private label products, HB products and non-HB products.

In the context of this Mapping study[1], questionnaires were sent by the Directorate-General for Competition to 11 SMs, which hold an aggregate market share of more than 95% of the food retail sector. The data obtained cover the period extending from 1/2/2023 to 30/6/2024. ("Reference Period").

The main findings are listed below:

- Total sales of Feta cheese from SMs in 2023 amounted to €244.1 million, showing an annual increase of 13.8%. In the first half of 2024, annual sales growth rate dropped to 3%.

- ~150 Feta suppliers are included in the data set. The 13 largest suppliers, in total, represent 70% of all Feta sales. The number of suppliers and the allocation of their shares indicate that the Feta supply market for SMs is characterised by low concentration with CR3 at 39% and HHI at 652.

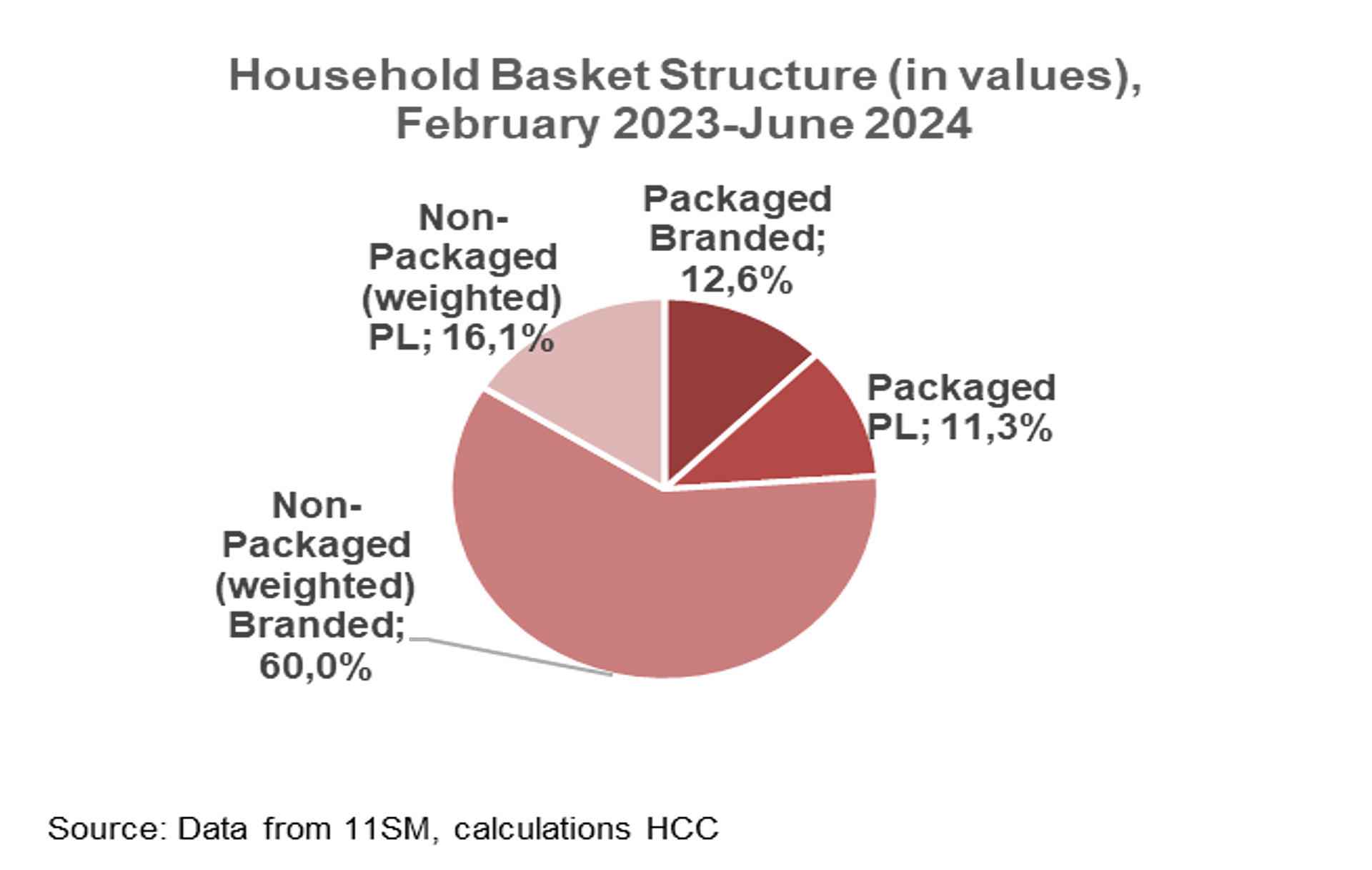

- In 2023, branded Feta products account for 80% of total market sales and private label products (HB and non-HB) represent 20% of total sales. The 12 largest suppliers account for 73% of total Feta sales by value while, in the market for private label Feta, the 13 largest suppliers account for 93% of private label Feta sales.

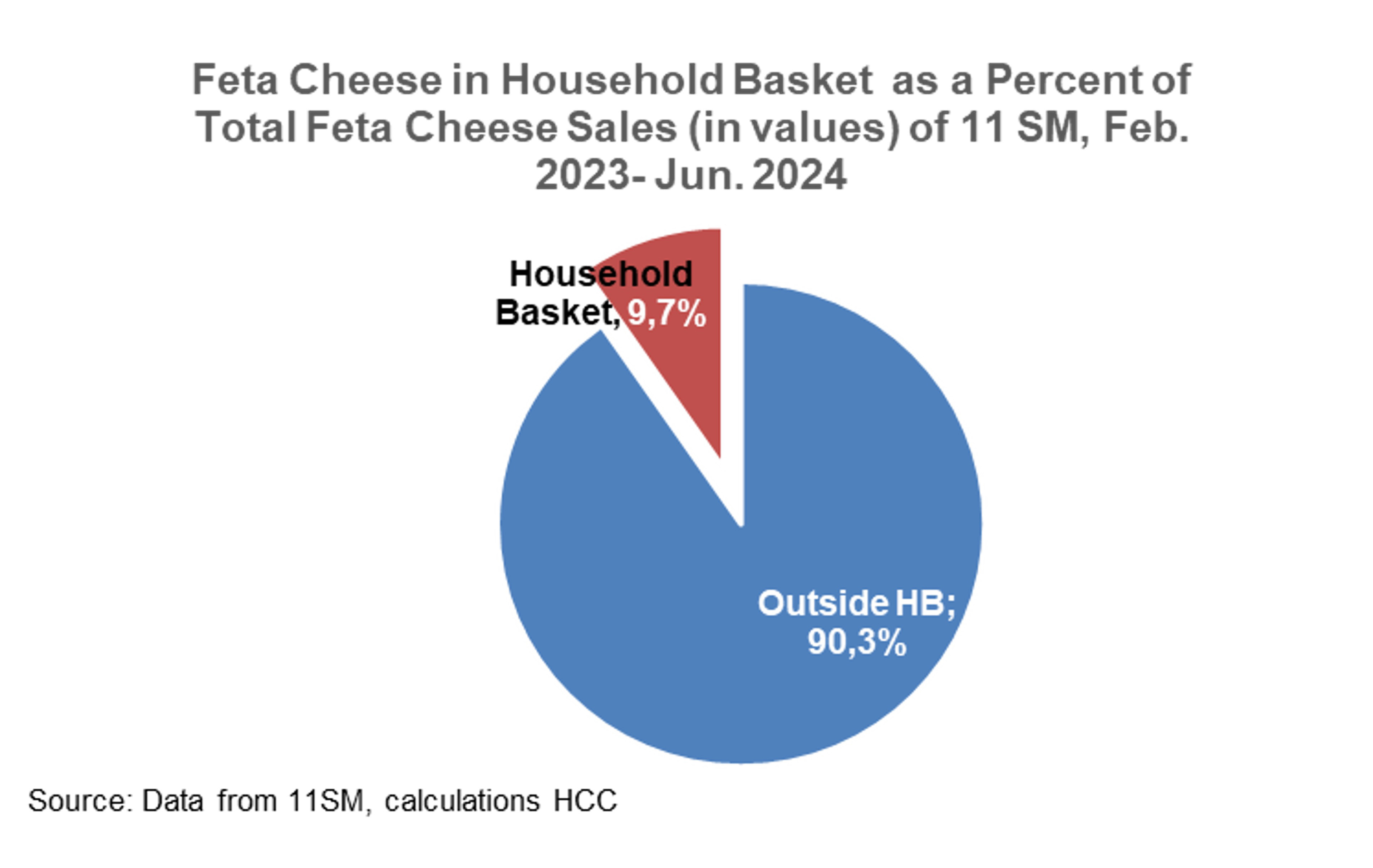

- Approximately 10% of total Feta sales of the 11 SMs results from HB-Feta sales.

|

|

|

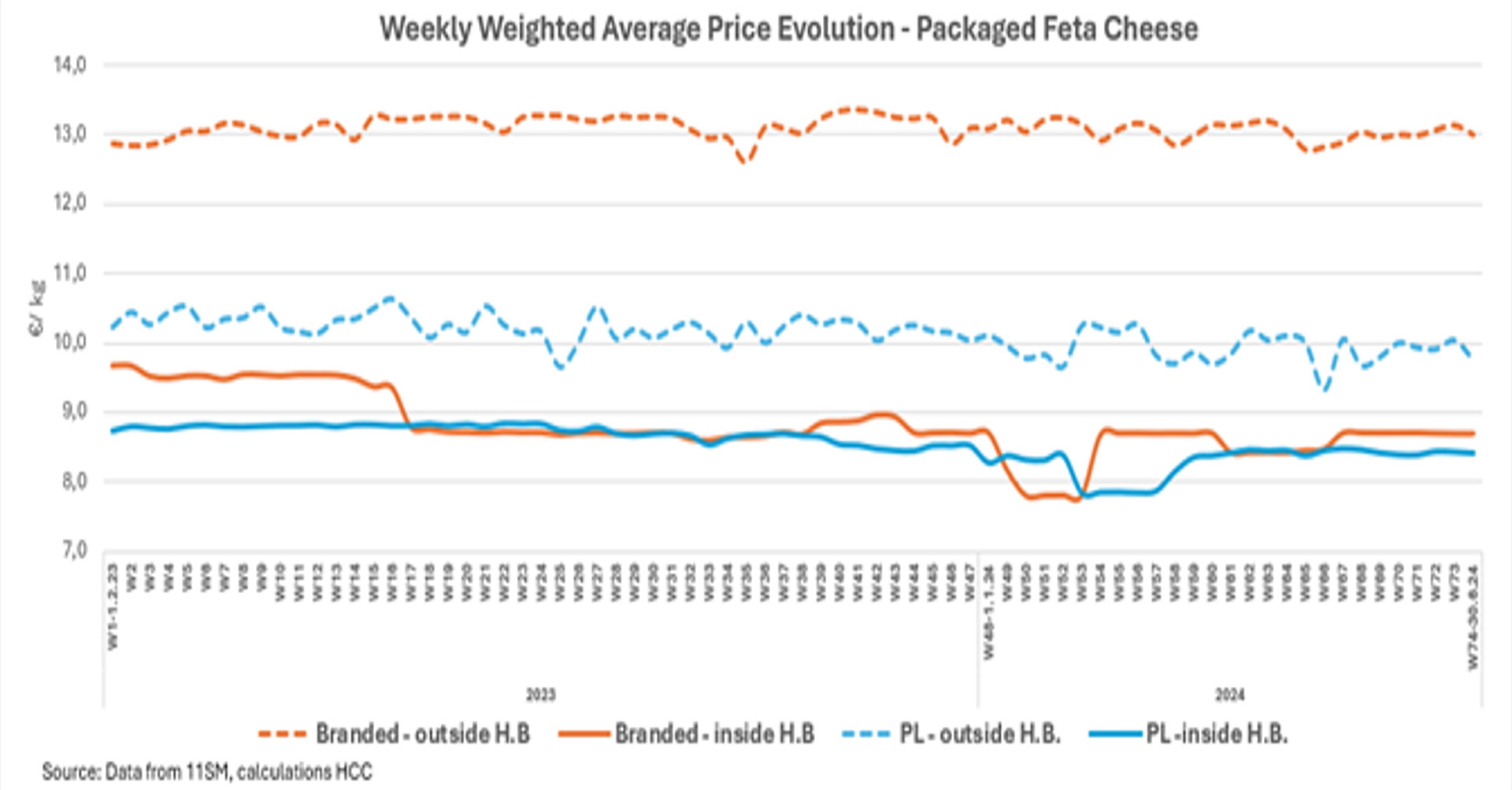

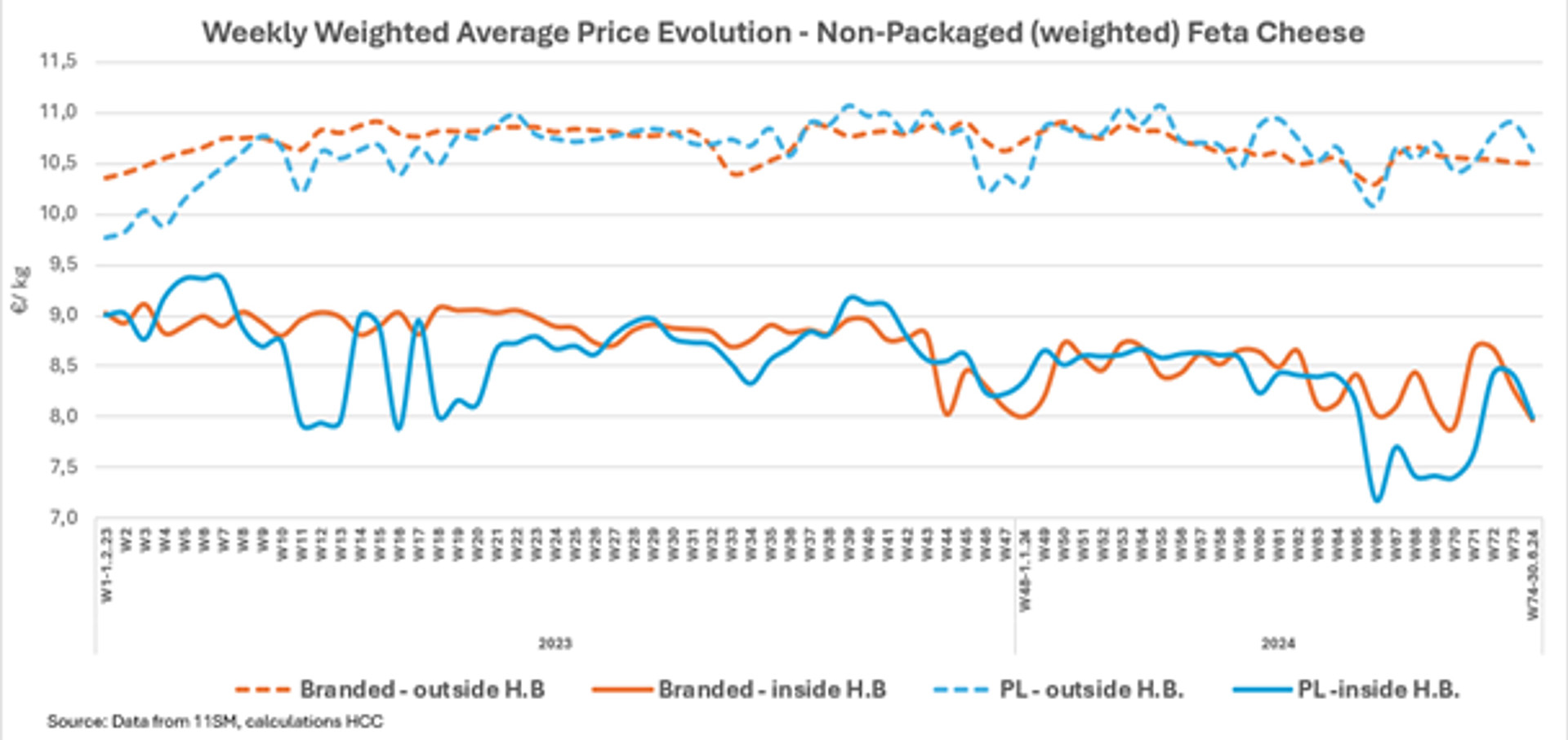

- The lowest prices of Feta are found in the weighed, private label, HB category, with a price ranging from 7.2 to 9.4 euros excluding VAT or between 8.1 and 10.6 euros including VAT.

- The highest price in Feta products (weighted average price per kilo) concerns branded packaged products, not included in the HB, with an average price of approximately 13 euros excluding VAT or 14.7 euros including VAT.

- Price differences by category are illustrated in the graphs below:

|

|

- In terms of consumer preferences. Consumers mainly prefer branded Feta (at around 82%, Feta products included and not included in the HB). However, during the reference period 2/2023-6/2024, a shift towards private label products was observed. This trend began in 2022 and continued throughout 2023 and in the first half of 2024.

- The HB does not seem to have affected consumer preferences (except occasionally in holiday seasons and summer periods).

- By considering the possibility of purchasing private label products and/or branded and private label products included in the HB, consumers can benefit from the lowest prices.

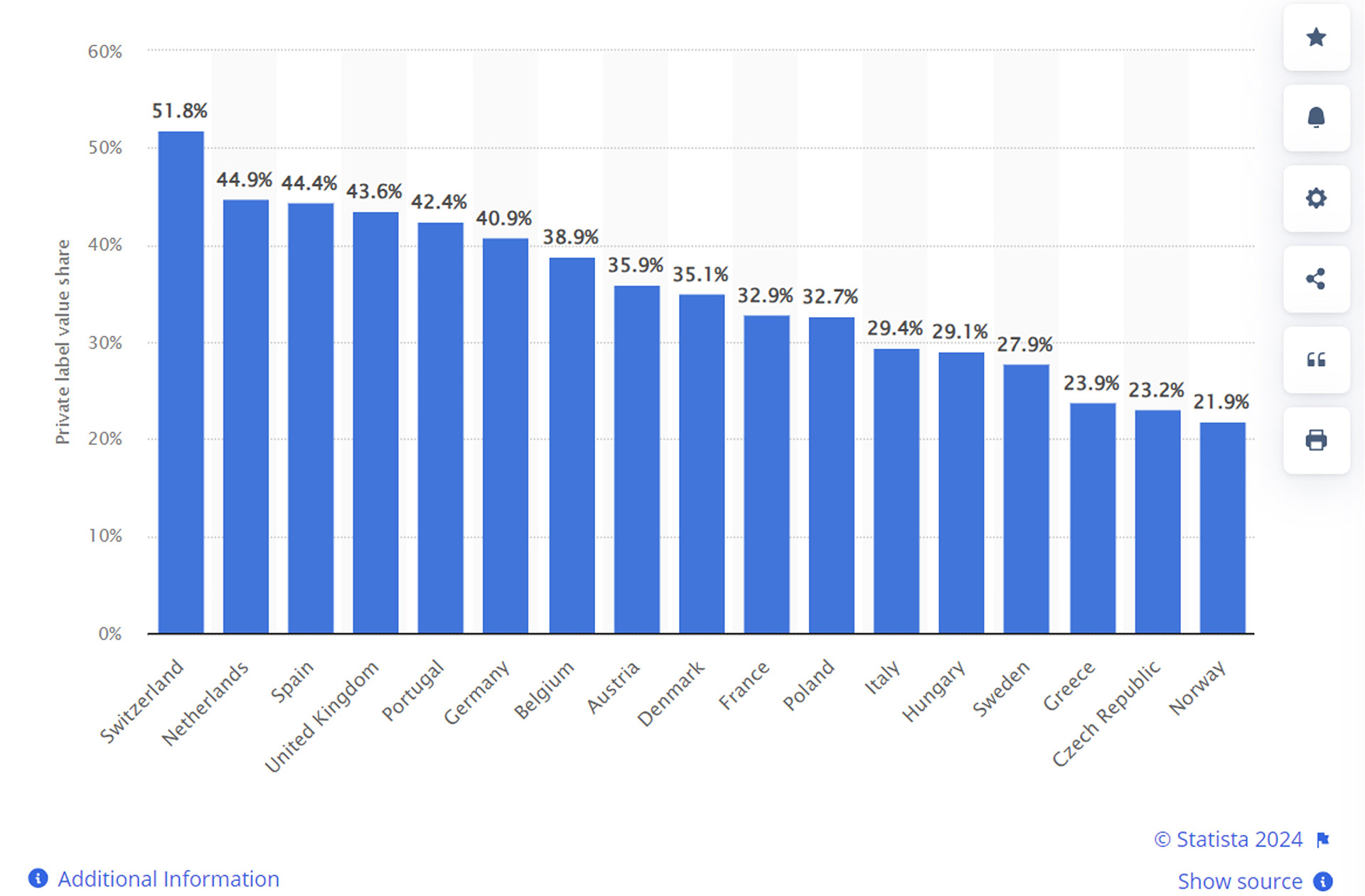

- It is noted that Greece is among the last countries in the ranking in terms of consumer preference for private label products, as shown in the graph below.

Sales value of Private Label Fast-Moving Consumer Goods (FMCGs), 2023

[1] Important Notes:

- The Household Basket (“HB”) was in effect throughout the period of reference.

- Suppliers’ market shares were calculated based on the 11 SMs’ sales made. The analysis does not include other distribution channels.

- All calculations have been performed using normalised prices (price per kilo) and weighted prices.

- The analysis concerns prices and sales quantities of Feta products, without a simultaneous analysis of their qualitative characteristics.

- Feta crumble was excluded from the sample, both because it is regarded as a residual product and because it does not come from a specific supplier.

- The VAT rate applied to the prices concerns the 13% applied on cheese products. The data collected did not allow any differentiation in the final price for the islands of Leros, Lesvos, Kos, Samos and Chios where a rate reduced by 30% is applied, i.e. VAT 9%.

For more details, see attachment: Mapping of the Feta cheese market, in PDF